Pre-seed

Raised

One of the most downloaded (850K+) and reviewed apps in Islamic Finance*

397K+ Active Users | 180+ Countries | 4.7 App Rating

The Serviceable Obtainable Market is approximately 400 Million Muslims* Capturing just 0.5% of this could mean potentially 2 Million paying customers, InshaAllah!

Google Cloud has chosen Musaffa to join its Google for Startups Program and has awarded $200K in credits to accelerate Musaffa's growth!

Musaffa has raised over $2.6 million in funding from accredited and unaccredited investors across 24 countries.

The founders invested over $250,000 to start Musaffa, and senior team members also hold ownership stakes. This aligns the interests of investors and management.

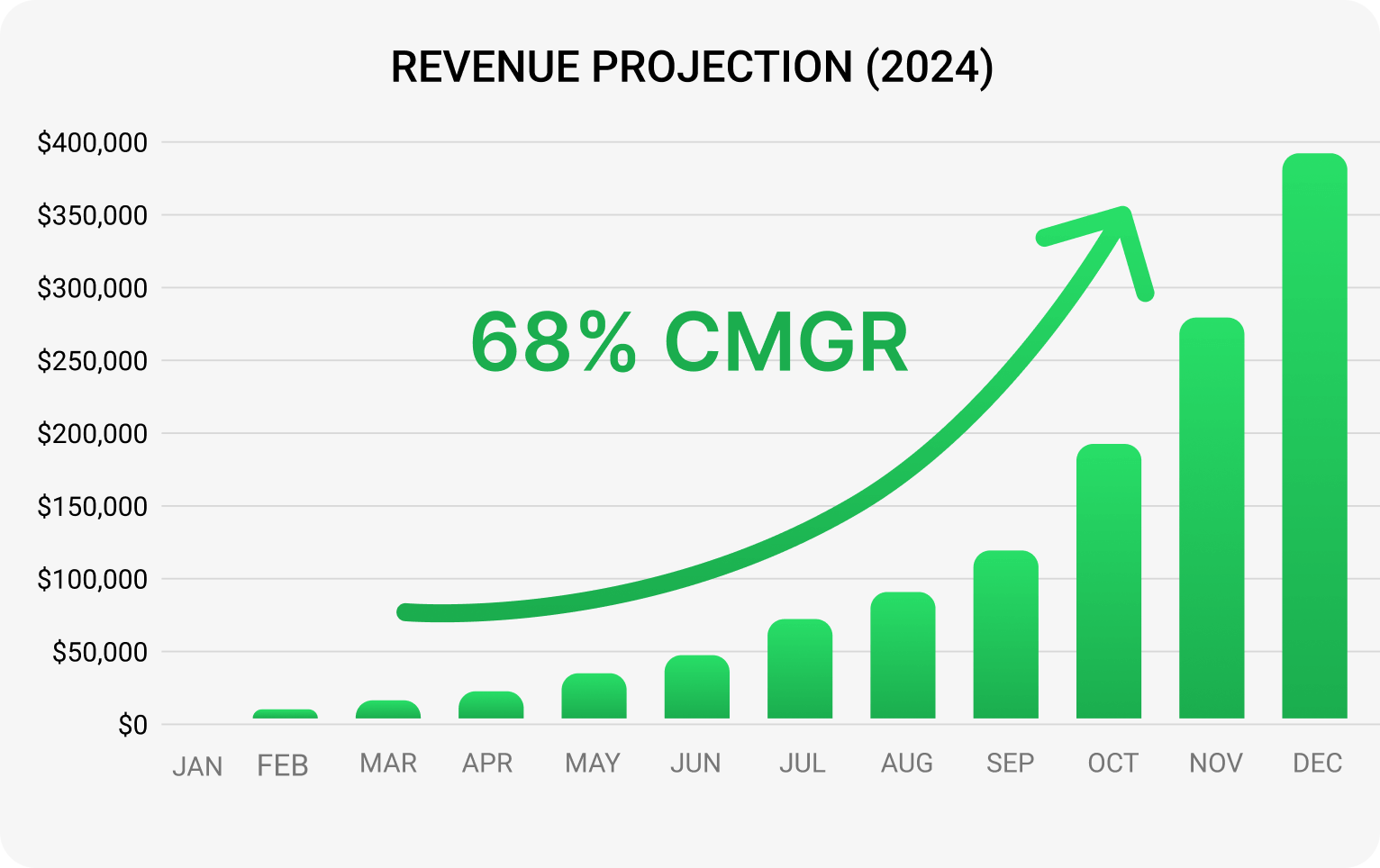

For over two years, we developed Shariah-compliant proprietary financial software before starting to monetize our products. In the last three months, we've gained over two thousand paying customers, with Musaffa's forecasted compounded monthly growth rate (CMGR) for 2024 at 68%*

The leadership team consists of individuals with extensive experience in working for and leading financial technology firms across the United States, UAE, and Canada.

Co-founder & CEO

Co-founder & COO

Co-founder & CTO

Chief Legal Officer (CLO)

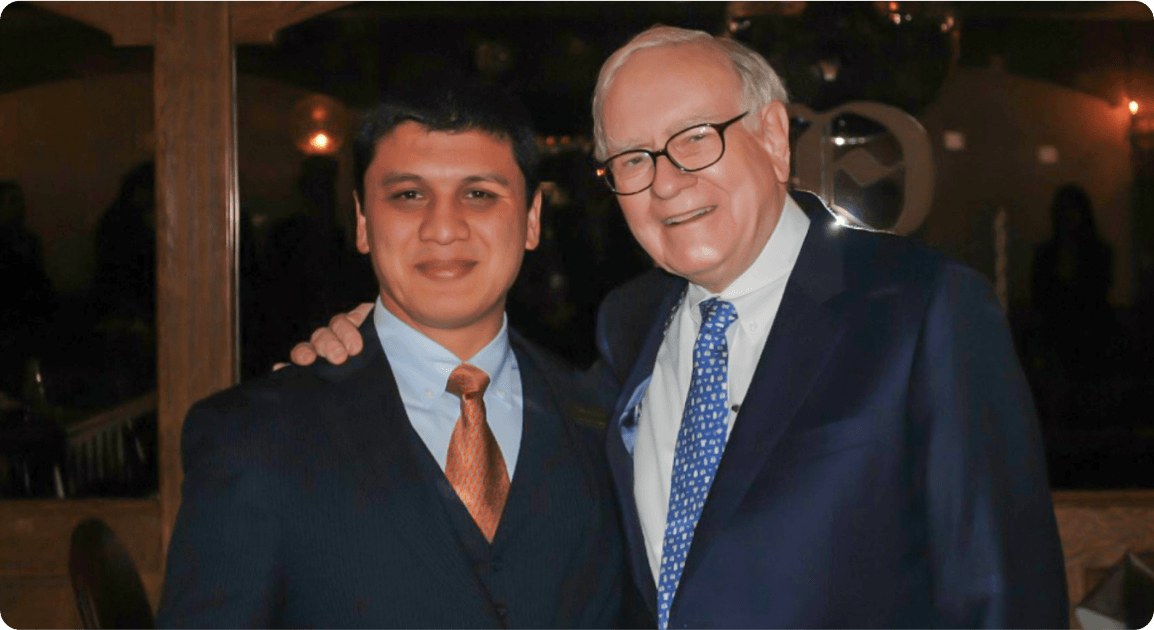

Dilshod Jumaniyazov and Warren Buffett,

Omaha, Nebraska 2011

As the co-founder and president of the University of Tennessee Investment Group, Dilshod had the honour of meeting Warren Buffett. After a meaningful discussion, Buffett's insights further inspired Dilshod to advance his vision of creating a global investment platform tailored for Muslims.

Shortage of education on Islamic finance and halal investment options despite huge global interest

Muslims are not allowed to invest in non-Shariah-compliant financial instruments, such as derivatives (such as options, forwards, futures, and swaps), bonds, and a majority of stocks and ETFs

No easy way exists for Muslims to screen, research, and invest in Shariah-compliant stocks & ETFs globally

Learn financial concepts and terms on this financial education platform, from basic Islamic and traditional finance to advanced investment strategies, and make informed and educated financial decisions.

Discuss finance, halal investing, and personal financial management online. Seek advice, share knowledge, and stay informed about market trends.

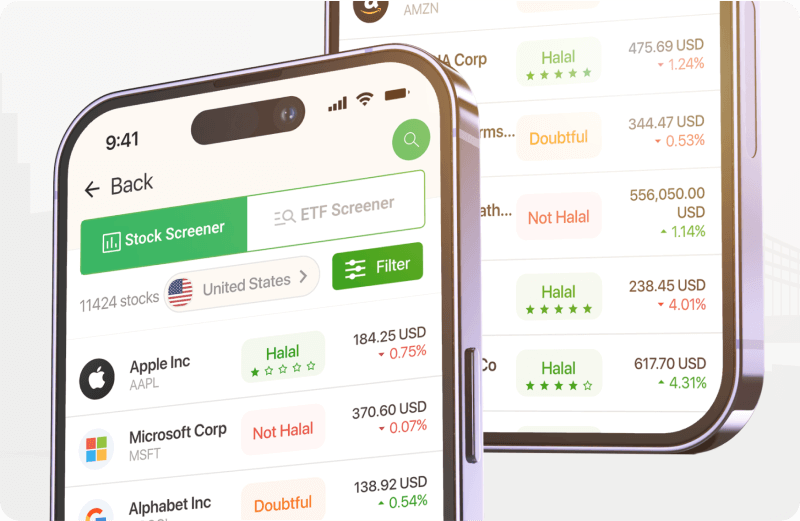

Screen over 120,000 stocks and 9,000 ETFs globally to find Shariah-compliant stocks and ETFs. Currently, our users can enjoy screening over 80,000 stocks and 3,000 ETFs.

Quickly screen and find the trending halal stocks, including stock bucket collections such as Halal top gainers, top losers, 52-week low, 52-week high, most active, and most popular stocks.

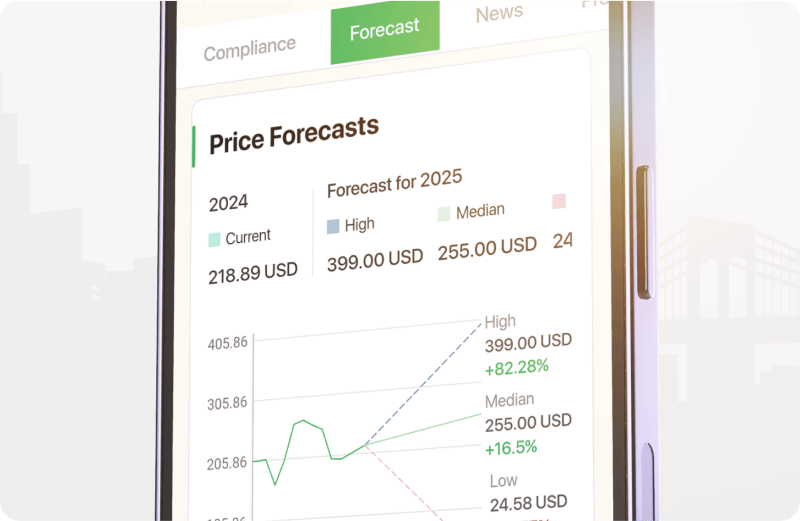

Conduct fundamental research to understand the risks and returns associated with potential investments comprehensively. Analyze company and market data to enable well-informed decisions, leading to the identification of profitable stocks.

Make well-informed decisions by assessing risk, financial health, business aspects, management, dividends, valuation, market conditions, liquidity, and portfolio alignment, with a focus on achieving long-term goals.

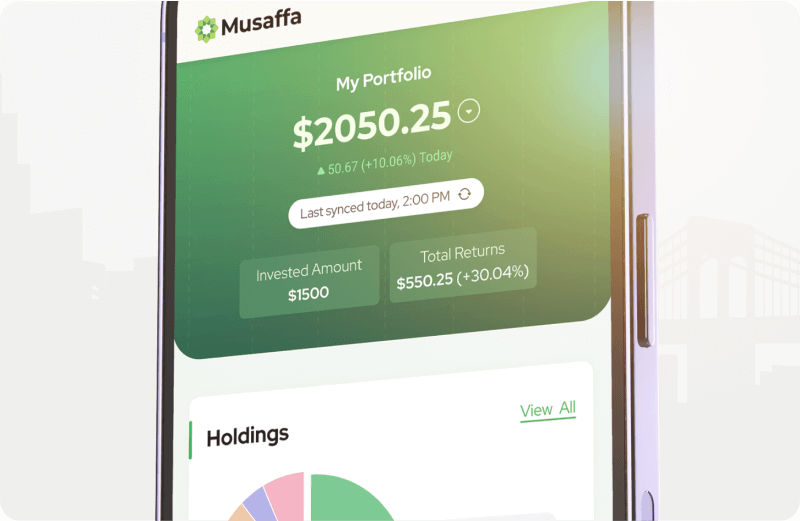

Link portfolios from current brokerages to the Musaffa platform/apps and monitor the Shariah compliance of investments in real time.

Invest only in halal stocks and ETFs locally and internationally by opening a brokerage account directly on the Musaffa platform.

Build customized portfolios to align with personal goals, manage risk effectively, maximize returns, adapt to market conditions, and address religious considerations.

Receive real-time alerts on Shariah compliance of investments, market events, price movements, portfolio adjustments, news, analysis, dividends. This facilitates managing risks and making informed investment decisions.

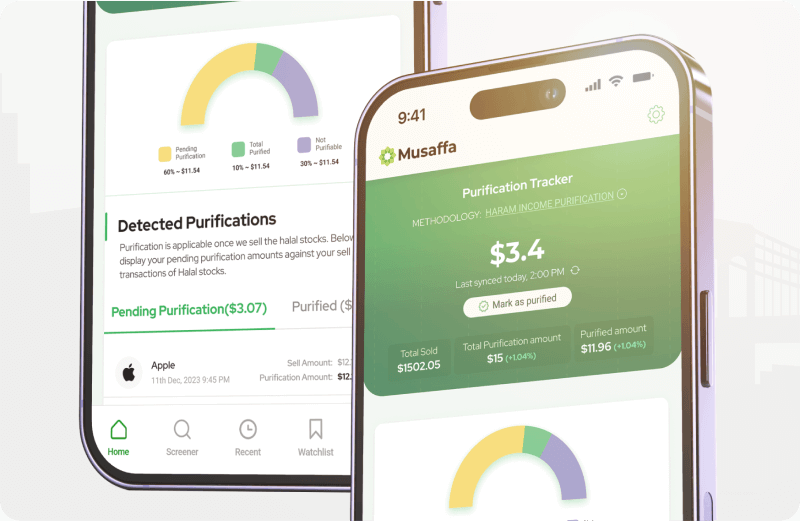

Purify your investments by donating the non-halal portion of profits from profitable investments, ensuring continuous Shariah compliance of your investments.

Accurately calculate and pay Zakat to support charitable causes, achieve spiritual purification, support the community, foster solidarity among Muslims, and, most importantly, fulfill a religious duty.

Shariah Board member of Accounting and Auditing Organization for Islamic Financial Institutions (“AAOIFI”).

Well-known UK-based Islamic Finance consultant and head of the global Shariah advisory firm Amanah Advisors.

Our Shariah board members continuously monitor our operations, systems, and technologies to ascertain that we are completely adhering to Shariah standards.

One World Trade Center,

285 Fulton St, Suite 8500,

New York, NY 10007, USA

Office 1802, Lake Central Tower, Business Bay, Dubai, UAE

1A, Mahtumquli street, 13th Floor, Yashnobod District, Tashkent city, Uzbekistan

Musaffa’s story begins in NYC with 3 passionate founders

Launched Web Platform with 12 Countries Covered New Office in Tashkent

Launched Mobile Apps with 50,000+ Stocks Covered

72K+ Users Globally 6 B2B Partnerships

New Office in New York Launched world's first Shariah-compliant ETF Screener

314K+ Users Globally The team expanded to 50+ members

New Offices in Dubai & Tashkent Portfolio Integration & Purification with 15 Brokerages

Musaffa’s story begins in NYC with 3 passionate founders

•Launched Web Platform with 12 Countries Covered •New Office in Tashkent

Launched Mobile Apps with 50,000+ Stocks Covered

•72K+ Users Globally •6 B2B Partnerships

•New Office in New York •Launched world's first Shariah-compliant ETF Screener

•314K+ Users Globally •The team expanded to 50+ members

•New Offices in Dubai & Tashkent •Portfolio Integration & Purification with 15 Brokerages

Enter your email to receive our investor pitch deck and stay informed about future updates.